Despite the challenge of cold chain logistics, and at the risk of batch quality and consistency, craft beer companies in India are penetrating non-metro cities by packaging their products

The beer market in India has radically changed in the past decade. There has been a significant shift in consumer’s preferences especially in Tier-1 cities. With the introduction of craft beer in the form of the country’s first brewpub in 2008, India has now has around 150 such establishments spread across the country.

Bengaluru, Mumbai, Pune, Gurugram, Hyderabad, Kolkota, Chandigarh, Punjab and North Goa have at least one or several brewpubs. Even though craft beer makes up just 1% of overall Indian beer consumption, it is growing at 20% year-on-year.

Craft beer has proved to be a unique, premium product that Indians across the nation have come to enjoy. Putting these beers in consumers’ hands outside of brewpubs and micro-breweries has been a challenge, primarily due to varying state excise policies.

In Maharashtra, for example, brewpubs are permitted to distribute their products to bars, taprooms and restaurants. Customers are still not allowed to do take away beers however. In Karnataka brewpubs are forbidden from transporting beer outside their premises.

Going local

The only solution to this problem is to follow the route the market leaders have taken and apply for commercial licenses that permit full-scale production and various packaging formats: kegs, bottles or cans. But to do this a decade ago was an impossible task – you had to be like one of the giants to afford production breweries that are like large factories.

The simplest workaround to this is to “contract” brew outside India and import your beers. This is exactly what the folks from Geist did in 2008 – they found a brewery in Belgium, provided their recipes and got bottled and shipped to India!

In the initial years import duties and the exchange rate for the US dollar didn’t affect Indian retail price points significantly. But by the year 2013, the Greenback became costlier, making Geist significantly more expensive than local lagers.

The founders decided to go the local brewpub route. Geist has since moved into production craft, focusing on kegging operations that started in 2017, from their own production craft brewery near Bengaluru. Geist also has plans to get back into the bottling race.

Other breweries that follow the production craft model of kegging are all based in Maharashtra. Gateway Brewing Company in Mumbai has been distributing kegs since 2014. Other production breweries in Mumbai and Pune include Ninkasi Brew Works, Bombay Duck Brewing Co., Kimaya Brewing Co., Great State Aleworks and Yavasura.

Enter Bira 91

In 2015, Cerana (B9) Beverages were able to come up with a similar concept and make the price points work. Bira 91 hit Indian shelves and presented itself to a slightly more mature Indian beer market. Bira’s two variants – Blonde lager and Belgian Wit – are contract brewed in Belgium.

Both imported variants performed very well, thanks to aggressive price points and a well-executed marketing plan that got the attention of the right customer demographic. Bira has since then spread its wings to markets outside India and has repeatedly made headlines for the right reasons globally.

Bira’s market success has opened up doors for other competitors to follow suite. So, what made Bira stand out? The brand is bright, appealing and unique, pricing is extremely aggressive and Bira 91 has well executed marketing campaigns.

Right before Bira was launched, brewpubs around the country started mushrooming. Consumers across the country automatically gravitated to two styles – wheat-based ales and clean, crispy, lagers. Both are easy drinking, sometimes on the sweet side and low in bitterness.

Kaama Impex launched Witlinger in 2014, with two variants which were brewed in Wales, UK. Initially only available on draught, the bottles followed two years later. Witlinger, which sells a lager and a European style Witbier, is now poised for a a comeback in a new avatar.

True craft

White Rhino Brewing Co. is India’s first independently owned production craft brewery. The family-owned-and-run venture in Gwalior (Madhya Pradesh) churns out some of the best bottled craft beer in India and, in true craft fashion, has limited availability. The owner’s attention to the minutest details reflects in the quality of the beer.

White Rhino has a Helles lager, a Belgian Wit and India’s most authentic bottled IPA. White Rhino is currently available in Delhi, Gurugram and Chandigarh.

Sona Beverages in Raipur was busy churning out commercial strong lagers for SABMiller. When SABMiller got acquired by ABInBev, it gave Sona’s owners (family owned) time to re-think options and the decision to invest into craft beer was made.

The company developed two new variants, a Belgian Wit with a twist (lemongrass) and India’s first bottled Stout. The market has reacted favorably to Simba, which is available in Goa, Bengaluru and Delhi. Mumbai and Pune are to follow shortly.

White Owl started off in 2014 as brewpub in Lower Parel, Mumbai. After gaining a few years of market experience it decided to get into bottling. White Owl is available in Mumbai, Pune, Goa, Bengaluru and now Delhi.

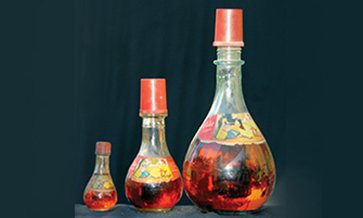

White Owl contracts its brew – Spark (Belgian Wit), Diablo (Irish red) and Ace (hybrid cider ale) – with Som Distilleries in Bhopal (Madhya Pradesh).

Toit from Bengaluru, the legendary brewpub has opened a production brewery in Pune and a taproom in Mumbai 2 years ago. It is now looking at building a production brewery in Bengaluru for bottling and kegging, perhaps even canning.

Destination Goa

Bengaluru’s Arbor Brewing Co. opened its doors in 2012 and has gone on to become one of the top brewpubs in the city. It is known for innovative special brews and hoppy IPAs, and was the first brewpub in India to launch a sour in 2015.

Arbor’s production brewery in Goa has finally rolled out the first batch a few weeks ago. Arbor has chosen to can and keg, instead of bottling and kegging. Three variants are currently available: Easy Rider (wheat ale), Beach Shack (IPA) and The Smooth Criminal (lavender ale).

Goa seems to be the new destination for production craft breweries. Goa Brewing Co. has started distribution of its kegs and bottled beers. It can be credited with having India’s second legitimate IPA in a bottle with its version of an Oat Cream IPA called ‘Eight Finger Eddie’.

Windmills Craftworks from Bengaluru and Independence Brewing Co. from Pune are both in the process of building their production breweries in Goa, much to the delight of both sets of fans!

Mizoram in the North-East becomes the first state with a production craft brewery. Mizo Brewery opened its door in 2018 and currently bottles a strong craft lager called ‘Local’. It plans to launch more variants next year.

Contract brewing

There are several other new brands that have just entered the market, all of whom are contract brewing in Europe. Happy Head, Mad King, Beirdo, Proost and Hopper are new craft beer brands being brewed in Belgium. Witty Bro is being brewed in Germany.

Thirsty Beers, with their brands Happy & Simon, contract brew in Bosnia. Keep an eye out for Hopper from Brindco, as it builds a massive production brewery in Karnataka to bring in more labels from Belgium to expand its portfolio.

But why look at Europe only when you want to contract brew? That’s what the team behind Kati Patang decided to do – contract brew in Bhutan at Ser Bhum Brewery. Their Amber Ale has now launched in Delhi, with other markets to follow soon.

Devans from Jammu & Kashmir have launched Six Fields, their interpretation of a Belgian-style Wit. Mahou wheat has just been launched by Mahou, and Kingfisher will be launching its craft series early next year.

The craft sector is growing at a rapid rate, and one can hope that as time progresses we can see India emerging as a country known for top class beers.