In Covid times, ‘experience over intoxication’ sees domestic demand soar for super-premium spirits and wines. Pic courtesy: Tiamo open-air dining at The Conrad, Bengaluru.

A recent article in The Financial Times describes it well: the “treat brain” they call it. Deprived of many of the usual pleasures that we are accustomed to – such as meeting a loved one or friends – a part of the brain that would normally apply restraint, lets free of the brakes, and allows indulgence to take over.

In the world of luxury and super-premium spirits and wine, the treat brain has definitely played a role in India, but not the only one in fuelling sales.

The disruptions caused by the Covid-19 pandemic, its aftermath in commerce and social life, have led to two (seemingly contradictory) trends emerging since the beginning of 2020.

On the one hand, there is a segment of health-conscious consumers that is moving towards no- or low-alcoholic beverages (Brews&Spirits, June-July, 2021). On the other hand, a segment of consumers is upgrading purchase choices to luxury and super-premium brands of spirits and wines.

The IWSR (International Wine and Spirits Record, 2020) shows an increase in the sale of luxury spirits, with Scotch categories starting from super-premium BIO (bottled in origin) and upwards, stacking at 17% of standard Scotch category in 2020 – this is up from 15% in 2018.

There has also been significant year-on-year growth in the categories of prestige Scotch (21.6%) and super-premium gins (20.2%). A report by Statista also indicates that the overall Indian alcobev market is expected to have a compound annual growth rate of 12.41% over the period 2021-25.

Angus Dundee has seen considerable retail upswing in brands like the Tomintoul Tlath and peated single malt.

Surge factors

By nature luxury and/or super-premium spirits, are limited in stocks because they’re typically produced in small batches and, depending on the category, may also spend 15-plus years maturing in barrels.

With ever-decreasing stocks of aged whiskey, we’re lucky that we can get our hands on some! The term used for this in the alcobev industry is “allocation”, which indicates how much of a company’s limited stocks of expensive alcohol have been kept for different countries.

One marketing manager tells me: “We ran through our allocation of super-premium Scotch twice in quick succession. The first time the parent company opened the taps; but the next time around even they had to decline.”

We can attribute this surge in this uber sector of the alcobev market to a few factors. Restrictions on international travel have had a double impact: it has transferred sales from travel retail stores to the domestic market; and has led to an increase in disposable income, because holidays have been curtailed.

Varun Choudhary, Marketing Manager of Pernod Ricard says, “The affluent consumers, who have been largely insulated from any Covid-19 related financial hardships, have seen a surge in their disposable incomes.”

Occasions for big social celebrations, which contribute significantly to the sale and consumption of alcoholic beverages, have transformed into multiple and smaller, more intimate gatherings.

These gatherings, as Keshav Prakash of The Vault (an importer of fine spirits) says, have become “smaller and more meaningful, with better conversations and better curation, leading to better serves for the guest”. Drinking is finally taking a more convivial, social hue, with the focus on “experience rather than intoxication”.

With premium bars and restaurants also remaining closed, or seeing fewer footfalls, the action shifted to increased pickup from liquor vends, with consumers treating themselves to more expensive fare – they could more readily afford it now, without the premium that a bar might charge.

Loch Lomond’s highly aged single malts and blends are in great demand.

Home premise

Sophia Sinha, marketing head for Moet Hennessy India, refers to this new channel as the “home premise”. It is unique because it has led to people experimenting with and trying new products and categories.

Ruchika Gupta, marketing head of Beam Suntory India corroborates this. “There is now renewed interest in home bar experiences as consumers remain hybrid between their favourite clubs and at-home scenes with smaller, familiar groups. This trend is here to stay,” she feels.

The more expensive the liquid, the perception (and reality) is that the quality is likely to be significantly better too; and with more consumers being mindful in about their intake, premium has definitely benefited.

The data at both a macro and micro levels appears to be bearing out this trend. As Keshav says, before the pandemic, 90% of The Vault’s sales came from bars. Even with the bar sector collapsing during the pandemic shutdowns, last year was the best year ever for The Vault!

Sales doubled for Keshav’s venture due to at-home consumption, with The Vault’s retail points moving up from five to 70 outlets in Mumbai. It was driven by retailers’ pull this time; they were in turn urged by their consumers to stock these brands.

According to Sumedh Singh Mandla of VBev, “Consumers may drink premium when they go out to a bar or restaurant; but they drink super-premium alcohol at home. With international travel suspended due to the pandemic they have no choice but to buy from the domestic market.”

He says the current trend is “drink less, but drink better”. The premium-plus spirits and wines in VBev’s portfolio have seen a 25% growth in the first half of financial year 2022. For the premium category, the growth stands at 15% in the same period.

As proof, Sumedh says VBev is introducing this year The Dalmore 15-YO and Elit Vodka to cater to this growing segment of discerning consumers across India.

Pernod Ricard’s star performers are Royal Salute 21-YO, Abelour 18-YO and Chivas Regal 25-YO.

Exploring expressions

For The Vault, consumers were also influenced by brands and trends they spotted on social media. That helped push the needle in favour of hitherto neglected categories like high-end agave spirits (Mezcal and Tequila) and curiosities like Armagnac and Calvados – both categories saw stocks run out!

“The market is primed and ready for world-class products,” says Keshav. “We tend to underplay the purchasing power of the Indian consumer, who is paying luxury prices for super-premium products, quite often three times that what their counterparts in the UK might be paying.”

Pushpanjali Banerji from Kyndal indicates that the biggest beneficiaries of this surge have been malts, with super-premium and ultra-premium volumes for blended and malt Scotch whisky increasing significantly.

The Macallan (owned by The Edrington Group) that Kyndal represents benefitted significantly, showing a “92% increase since 2019”.

Varun Choudhary from Pernod corroborates this, indicating a “strong performance across brands in the ultra-premium and prestige range, particularly Chivas 15-YO, Ballantine’s 21-YO and 30-YO, and The Glenlivet higher aged expressions.”

Hasan Bakhtawar, Chief Operating Officer of Angus Dundee (India), has also seen considerable retail upswing in the company’s single malt portfolio with brands like Tomintoul.

For Ian Macleod too there has been an uptick in sale of super-premium spirits –mainly Scotch and Japanese whiskies – in Mumbai, Bengaluru, Delhi, Gurugram and Chandigarh. For the company, the sale of its brands has shifted from airport duty-free to domestic duty-paid market.

Keshav (The Vault) says that with more time on consumers’ hands, curiosity is on the rise, leading to interest in off-beat expressions that he stocks. The Kilchoman and Compass Box touch the Rs. 14,000 (per unit) price point.

With India very much also in the middle of a gin wave, premium gins like The Vault’s Cotswolds Ginger Gin (upward of Rs. 12,000) was completely sold out. Brands see gin very much in the middle of a good run, with at least 3 years more to go, and Tier-2 cities also just beginning to discover it.

Encouraged by the trends VBev is soon launching the Dalmore 15-YO single malt Scotch whisky and Elit-18 vodka in India.

Upscale shopping

Drinks companies keenly observant of these trends have actively focused on ensuring that retail vends are well stocked with their premium products – and, wherever the regulatory environment permits, pushing high quality merchandising to further attract consumers.

Just witness the retail vends in Gurugram and Bengaluru that could give any duty-free shop a run for its money, not just in terms of the merchandising quality, but also the well-trained staff and qualified wine and spirits professionals on hand.

These trends are also spreading to Tier-2 and Tier-3 cities. Guwahati (Assam) and Margao (Goa) can also boast world-class liquor vends like The Whiskey Company and Vaz Enterprises.

Vishal Deorah of The Whiskey Company indicates that apart from malts like The Macallan, their Japanese whiskies have also done very well. He also started “invite-only sales”. The Whiskey Company sold out its entire annual allocation of Laurent Perrier Rose Cuvee 96 bottles (Rs. 18,000 a bottle) in a 48-hour sale!

The Whiskey Company has a WSET Diploma Holder as its in-store sommelier, directly imports 45 labels of super-premium wines, with prices ranging from Rs. 10,000 to Rs. 45,000. Vishal says multi-nationals are also ensuring now that brands that were hitherto restricted to the metros are finding their way to cities like Guwahati.

It is also policy impact in states such as Maharashtra, which now permit e-commerce and home delivery by liquor stores. “Discovery” has suddenly become easy on the part of the consumer, especially as most Mumbai stores have cramped interiors with little scope for browsing the aisles.

The new excise policy in Delhi will also allow the creation of ultra-premium stores in each zone, in which in-store tasting will also be permitted. ‘Liquid on the lips’ is seen as a sure way of conversion for expensive and exotic spirits.

Mumbai-based The Vault is letting consumers in on expressions such as Compass Box Peat Monster Scotch, Kilchoman’s Machir Bay single malt and Silent Pool citrus gin.

Fine dining

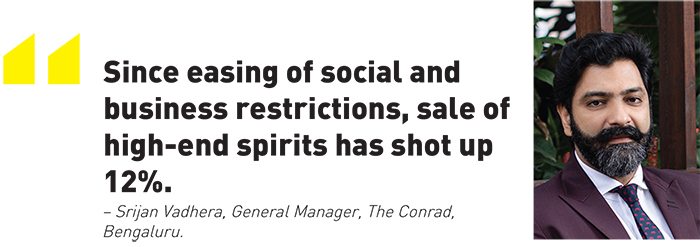

As markets open up, these luxe experiences are also shifting to premium establishments across the country, with hotels like The Conrad (Bengaluru) putting in place more experience-based evenings like wine dinners and experiential dining concepts.

Srijan Vadhera, General Manager of The Conrad, says he has been engaging with brand ambassadors of various beverage brands to help curate experiences for his guests. His high-end spirits sales have shot up 12% after social and business restrictions because of Covid-19 have eased.

Rukn Luthra of Fermentras, who represents Loch Lomond Group in India, says the increase in demand for super-premium brands over the last few months has benefitted whisky the most because consumers have been searching for supplies of highly aged single malts and blends.

“The reason seems to be that people want to indulge themselves during these uncertain times. Even at small and intimate gatherings at home the hosts want to indulge their close friends and family members with top-of-the-line beverages,” he feels.

Well-known mixologist Pankaj Balachandran, who runs Tesouro By Firefly bar in Colva (Goa), vouches for a substantial rise in consumption of super-premium and luxury beverages. “In the last few months, other than the high-ticket Cognac and wines, I have seen expensive Tequilas and whiskies making a mark. So I can say the demand for high-value spirits is picking up.”

The Whiskey Co., Guwahati, sold out its entire annual allocation of Laurent Perrier Rose Cuvee 96 bottles (L) in a 48-hour sale. The Macallan 12-YO Double Cask (R) comes from Kyndal Group.

As a bar operator, his team often conducts tasting sessions of high-value alcoholic beverages (along with food), even if the bar doesn’t sell them. “Once people appreciate the taste of the liquid, it is etched in their memory and they will keep it for a special day or evening. There is always a turnaround of sales once this happens,” Pankaj says.

He thinks it is high time that brands start educating the trade on these high-ticket spirits as they (bars) are the ones that are really selling the brand day in and day out.

Such experiences are also likely to see an upswing on the part of premium brands, either hosted in upscale bars or hotels, or for small groups in or out of home.

“This is likely to become a long term habit,” says Sophia (Moet Hennessy), with the longer consumers exposed to high-quality products, the more likely a change in their permanent consumption pattern.

More Millennials are entering their consumer set, who are more curious in nature, and looking for a diversity of experience. This is going to keep drinks brands on their toes too, as they can’t rely only on a loyal lifetime consumer of their brand, but a “revolving audience”.