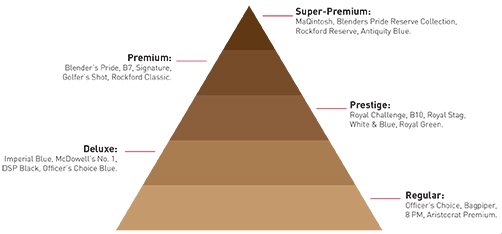

With double-digit growth, Indian Premium and Prestige whiskey segments are where the competition is getting bolder

Oaksmith, Rockford, Hawkston, Sterling Reserve B7 and B10, Royal Green, Rockdove, Golfer’s Shot… The list gets longer if we consider local and regional whiskey brands.

All these are jostling for space in what has become an increasingly crowded sweet spot of the Indian whiskey market – the Prestige and Premium segments, marked by large size and double-digit growth.

India continues to be the world’s largest whiskey market, with brands such as Officer’s Choice, McDowell’s Number 1, Royal Stag and Imperial Blue, all featuring in the list of Top-10 spirits brands in the world by volumes.

There are 19 million consumers joining the legal drinking age every year; so it is no wonder that it is also fast turning into one of the most competitive markets in the world.

According to IWSR (International Wine and Spirits Record) data in 2018, the Indian whiskey market was upwards of 212million cases, out of which just 2% was represented by imported whiskies.

About 45+ million cases of the balance fall into the Prestige and Premium segments, with the Premium segment especially growing in high double-digits. Other segments of the whiskey market have been growing at a comparatively lower rate.

New challengers

These segments of the market have hitherto primarily been the preserve of Diageo and Pernod Ricard. Both companies also have the advantage of owning several brands in the Scotch segment, both bottled in India (BII) and bottled in origin (BIO), thus offering their customer an easy upgrade path to follow.

What has changed in the last few years is the entry of a number of new brands, from large and mid-size Indian companies such as Allied Blenders, Alcobrew Distilleries, ADS Spirits, Oasis Group and Modi Illva – as well as the recent entry of Beam Suntory, a multi-national.

In earlier times, if the larger brands could have hoped to pick up a fair share of the growth in the market, there is now a more even share being chalked out across smaller brands. Industry insiders estimate that Royal Green, White and Blue, All Seasons and Sterling Reserve’s B7 have upwards of 5 million cases of sales between them in the Prestige segment.

In the normal course, a large part of these sales would have gone to the market leaders, brands like Pernod’s Royal Stag and Diageo’s Royal Challenge.

A similar situation also prevails in the Premium segment with brands like Golfer’s Shot, Rockford and Sterling Reserve’s B10 making inroads into the territories of Blender’s Pride (Pernod) and Signature (Diageo).

What’s changed

These brands are not flashes in the pan. The consumer in these segments is more discerning and can’t be short-changed, either when it comes to the blend quality or the brand values.

As Anant Iyer, COO of Alcobrew says, “These are segments (Prestige and Premium) that you can’t push, but where you need a groundswell of consumer liking. It has to be a wholesome offer and consumers have to like the brand in order to repurchase.”

The upper end of the Indian whiskey segment (Premium and Super-Premium) has a narrow price gap with Scotch brands, either BII or even sometimes BIO, especially in markets such as Delhi and Haryana, which are large whisky markets.

We nowadays see consumers rotating between Scotch and Premium/ Super-Premium Indian whiskey, depending on budget and occasion. A consumer who tastes Scotch on a regular basis and is attuned to these packaging standards will also require near equivalent blend quality and packaging standards from any other whiskey s/he drinks.

There are some factors for the developments cited above, both from the industry’s side and from consumer trends.

Going premium

There is a growing trend of leap-frogging by consumers. Beer typically may be their entry point into alcoholic beverages; but they jump to Prestige or Premium whiskey segments rather than going rung by rung on the whiskey ladder.

As a result companies are focusing on getting their offering here right, and having a superior proposition in the Prestige segment, so that customers can then stay within their brand family itself as they upgrade to the Premium segment.

Cases in point are Allied Blender’s Sterling Reserve with B7 and B10; Alcobrew with White and Blue and Golfer’s Shot; Beam Suntory with the newly launched Oaksmith and Oaksmith Gold; and Modi Illva with Hawkston and Rockford Classic (Rockford Reserve in the Super-Premium segment).

As Abhishek Modi, Executive Director for Modi Group of Industries says, “The segments of Super-Premium and Prestige will continue to grow. We are betting on the continuing move towards premiumisation, as raw material and packaging costs exert margin pressure on the lower segments.”

The Super-Premium segment represents the last milestone for consumers before they hit Scotch. With increase in disposable incomes and aspirations, there is also a need on the part of the consumer to upgrade “quality” and “badge value” of the brands they consume.

Pan-India moves

Some companies are also introducing brand extensions. As Virat Maan, Business Head of ADS Spirits says, “It is financially more viable to launch a brand extension of a well-accepted brand vis-à-vis launching an entirely new brand. Of course, we have seen certain brand extensions haven’t performed as expected and haven’t held their own.”

Leading Indian single malt brands like Amrut have also smartly begun playing in this Super-Premium segment, getting consumers acquainted with the brand before they can trade up to its single malts.

MaQintosh whiskey was launched by Amrut Distilleries 30 years ago, but with availability in just a couple of states. This year has seen it go national, with pan-India distribution.

Pramod Kashyap, DGM International Operations says, “Our blended whiskies carry a good quantity of our classic malts along with the grain spirit, blended and married to perfection. It’s just a matter of time before we give the big boys a run for their money.”

ADS Spirits’ Royal Green whiskey (L) was identified as the fastest-growing Millionaire whiskey brand in the world. Amrut Distilleries’ MaQuintosh (R), launched 30 years ago, is going Super-Premium with pan-India distribution.

Blends & diversity

Attractive packaging and price point are crucial, but what is even more so is the blend quality. Without getting the quality of the blend right and the taste in accordance with the Indian palate, the entire launch will come to naught.

Brands are, therefore, paying considerable attention to the blend, and also focusing on differentiating the blend as much as possible. A recent case in point is the twin launch of Oaksmith and Oaksmith Gold from Beam Suntory India.

This blend has been personally crafted by whisky legend, Shinji Fukuyo, who paid no less than six visits to India, during the blend development process, traveling across the country to understand food culture and flavours.

The Oaksmith blend incorporates Scotch malt and American bourbon whiskey, all brought together by Japanese blending craftsmanship.

As Rishi Walli, Director for Marketing at Beam Suntory India says, “Our blend is our primary point of differentiation: it is high quality, authentic and pure.” Oaksmith is a critical launch for Beam Suntory India and forms an integral part of their aim to reach US$ 1 billion in sales by 2030.

Packaging & branding

Oaksmith comes in a beautiful six-sided bottle, with bevelled edges and a tall neck. Rockford and Rockford Reserve from Modi Illva have brand and packaging values that would do a Scotch whisky proud. The Golfer’s Shot bottle has a cap-on-cap design, mimicking the look of a ball placed on a tee.

ADS Spirits, whose Royal Green whiskey, has claimed volumes of 2.3 million cases across 14 states and that was also identified as the fastest-growing Millionaire whiskey brand in the world in 2019 by Drinks International, comes in a unique green bottle.

Branding, design and packaging are playing even more important roles than before. The market leaders are taking note and Diageo, whose McDowell’s Number 1 dominates the Deluxe segment, also recently hired Singapore-based Design Bridge to help in the brand renovation.

As Virat Maan, Business Head at ADS Spirits says, “With increasing internet penetration and advent of smartphones consumers in India are more ‘connected’ than ever before and have higher levels of exposure to various brands and their offerings.

“These new-age consumers are better informed and are more likely to experiment and try out new or different brands when offered better value, such as packaging design, quality blend and an enhanced consumer experience,” he adds.

Many new brand offerings have managed to woo consumers in the Prestige segment and above due to their being open to experimentation. Both points are equally valid: this experimenting customer is open to exploring options as is the trade, both on and off.

Abhishek of Modi Group corroborated by saying, “A well-known emerging trend is information-centred shopping, in which consumers search for a great deal of information about a product or service before putting down money.”

Market leaders Pernod Ricard and Diageo are alive to the threat being posed by these brands and have also unleashed a flurry of moves to counter them. Introducing new brand extensions to create sub-categories is one such example.

Royal Stag Barrel Select (Prestige), Blender’s Pride Reserve Collection (Super-Premium) and the portfolio renovation of McDowell’s Number 1 are cases in point.

Alcobrew Distilleries’ Golfer’s Shot (L) and White & Blue have taken the Premium route.

Crystal gazing

In a recent interview with afaqs.com, Amarpreet Anand, Executive Vice-President at Diageo, says: “This change is probably the biggest one after the launch of the brand in 1968... We’ve relooked the blend, the packaging, the bottle’s shape and size.”

What changes are we likely to further witness in the years to come? We’re sticking our neck out and forecasting that:

We wouldn’t be surprised if Indian companies venture into blended Scotch territory by tying up with distilleries in Scotland and launching their own brands, whether BII or BIO;

Expect more multi-nationals (like Beam Suntory) to also enter the Indian whiskey market, either starting their own brands or by acquiring some of the smaller players;

Expect Indian whiskies to grow more sophisticated in their blends and taste profiles. Don’t be surprised to see peated malts make their way into Indian whisky blends!