As the third largest alcoholic beverage market, India represents one of the most compelling spirits opportunities in the world. Within this, the alcoholic ready-to-drink (RTD) segment is experiencing high growth and is expected to grow at a CAGR of 10.3% between 2021-26.

Its popularity can be attributed to the convenience it offers, and its being a lower-strength alternative to spirits that is being driven by consumer desire for healthier alternatives.

However, its growth is stymied by low availability, finds a survey with users. Benori Knowledge, a global provider of custom research and analytics solutions across industries, conducted an online survey of over 1,000 alcoholic beverage consumers that had 70% male and 30% female respondents.

The survey was conducted to understand the growing RTD cocktail market in India, current awareness, consumption, and preferences. Of these 62% of survey respondents were in Tier-1 cities and 38% from Tier-2 cities.

Mass appeal

The findings show that the RTD category has sparked mass appeal, with 78% of survey respondents reporting having consumed pre-mixed beverages. Nearly 55% say they prefer RTDs over spirits owing to its lower alcohol strength, which makes it the ideal beverage to consume in social settings.

Contrary to popular perception, 79% of RTD consumers are male and 21% are female. Interestingly, among the 22% non-drinkers, there is a high awareness of RTD cocktails and they also expressed their desire to try them in the future.

Awareness of RTD cocktails is primarily driven by word of mouth for most. Most (66%) survey respondents say they learnt about it from friends and family, while 19% say they heard about RTDs from social media.

Most (84%) men surveyed confirmed drinking an RTD cocktail at least once a week, while the same frequency was confirmed by 61% of the women.

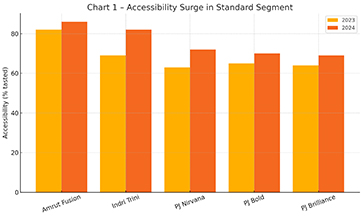

However, survey respondents cite the challenges of low availability (65%) and limited variety (35%) in their ability to get their hands on these beverages.

Unlike the usual consumer buying behaviour in India, price is given the least consideration when purchasing RTDs. Benori’s research finds that brand image, taste and flavour, and the percentage of alcohol (5% or less is preferred) are the key factors that influence and drive purchase in this category.

Most popular

The report also highlights the most popular brands in this category. Bacardi emerges as the most popular brand in preference, consumption and enjoys high awareness, followed by Magic Moments Electra and Bombay Sapphire Gin & Tonic.

Commenting on the report, Ashish Gupta, Co-founder and CEO of Benori said, “Indian consumers today are ready to experiment and go beyond traditional alcoholic beverages. The RTD category especially is becoming quite popular across the board.”

Among young drinkers, there are those who are just beginning to consume alcohol and prefer the low alcohol content and the variety in flavours of RTD over beer. Others are more seasoned, yet willing to explore and try new things.

Among older drinkers, many choose RTDs over traditional drinks for a convenient experience or when they are looking for beverages to enjoy casually and not consume hard liquor.

The popularity of RTDs clearly demonstrates a need for low-alcohol beverages that offer innovative products and flavours and are readily available. “Alcohol companies would benefit tremendously by riding on this trend,” Ashish says.