The Single Malt Amateur Club (SMAC) India, which has been championing whisky appreciation since 2011, curating trail-blazing tastings and independent bottlings, has analysed data from its annual membership survey to power this 5th edition of its Indian Whisky Survey for 2024.

As always, SMAC India will keep the conversation honest, independent and data driven.

The 2024 survey drew over 500 validated responses, giving us a statistically sound barometer of what India’s single-malt drinkers are really buying, chasing and discussing. For the first time we also asked members to rank whiskies by flavour style (sherry-influenced vs peated), adding a sensory lens to the usual brand leaderboard.

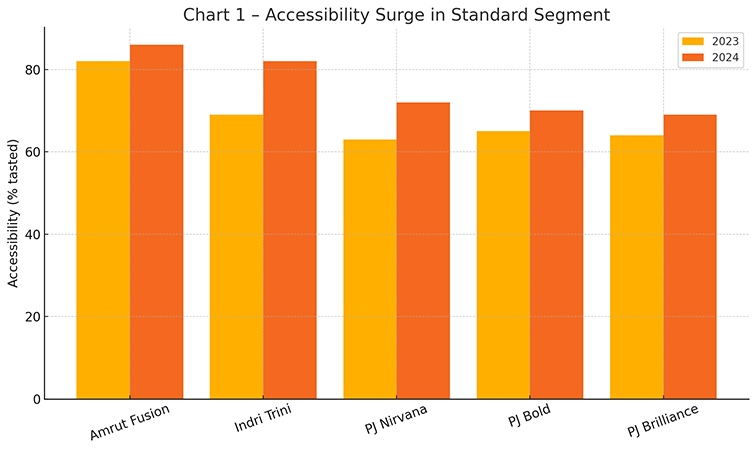

Accessibility drives love in the ‘standard’ tier – do distribution is destiny! Five flagship malts under ₹6,000 all became easier to find in 2024, but Indri Trini’s visibility jump (69% to 82%) is the standout. Its 13-point leap almost matches the long-time yardstick, Amrut Fusion (now at 86% reach), and helps explain why Trini rockets to joint #1 in overall preference.

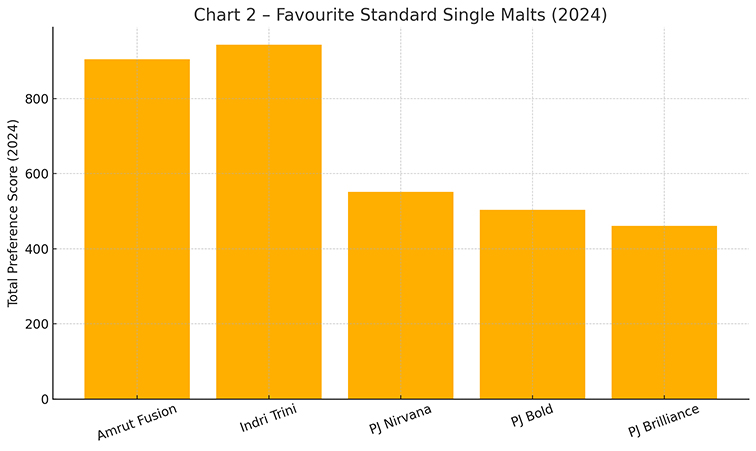

Photo finish

When we convert every ballot into a weighted score, Indri Trini sneaks ahead of Amrut Fusion (943 vs 904 points). Yet, on the one metric that whisky lovers revere most – the raw count of first-place votes – Amrut Fusion still clings to the crown, but only by a whisker.

Rampur Select records the biggest year-on-year leap (+234), and Paul John’s trio (Bold, Brilliance and Nirvana) round out the top five, confirming that Goa’s workhorse distillery now commands national loyalty well beyond its peated niche.

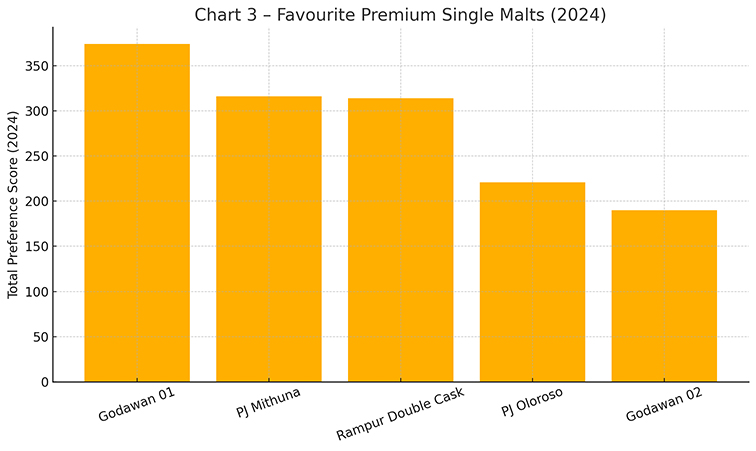

Higher up the price ladder Diageo’s desert-oak Godawan 01 storms straight to the podium with 374 points and 34 first-place ballots. Paul John Mithuna still converts the most #1 votes (38), but marginally surrenders the crown on cumulative score.

Rampur Double Cask completes the top three, separated by barely 60 points, illustrating how competitive India’s “luxury” malts have become.

Sub-plots

Adding a flavour lens (style-based voting) clarifies what stories land with Indian palates. The Sherry-influenced champion was Indri Trini, which captured 30% of first-place ballots and “more than half the total stack points”, dwarfing every other fortified-wine-matured dram.

Paul John Bold remains the nation’s smoke benchmark, topping 36% of ballots and appearing on nearly 7 in 10 tasting logs. Newcomers will now need a sharper cask narrative or exotic peat source to challenge those incumbents.

The survey also threw up some noteworthy sub-plots, such as:

- Rapid reach: Godawan’s range gained ~40 % new tasters in a single year.

- Limited editions work: Paul John’s annual Christmas malt reaches 23 % of respondents in its launch quarter.

- Demand still outstrips supply for Amrut’s special releases—Fusion X, Bagheera and Fusion XI dominate wish-lists, signalling room for larger allocations.

Five years of data now point to a maturing, but far from saturated, Indian single malt whiskey market. Consumers reward availability, authentic cask stories and credible flavour differentiation. Yet, the wish-list charts remind us there is still pent-up demand for genuinely new flavour experiences.

To discover SMAC events, insights and membership benefits, visit www.smacindia.com. Until next year, cheers to curiosity and to the drams that deserve it!